The Side Hustle Retirement Fund Report

New survey data shows how Americans use side hustles, extra work, and AI tools to save money, manage burnout, and rethink retirement timelines today.

What Is Issue-Age Pricing For Medigap?

Learn how issue-age pricing for Medigap works, how it compares to other models, and how enrolling early can help you lock in lower lifetime premiums.

Does Medigap Get More Expensive as You Age?

Learn how Medigap pricing works, what affects your premiums over time, and how to choose an affordable plan that fits your long-term retirement goals.

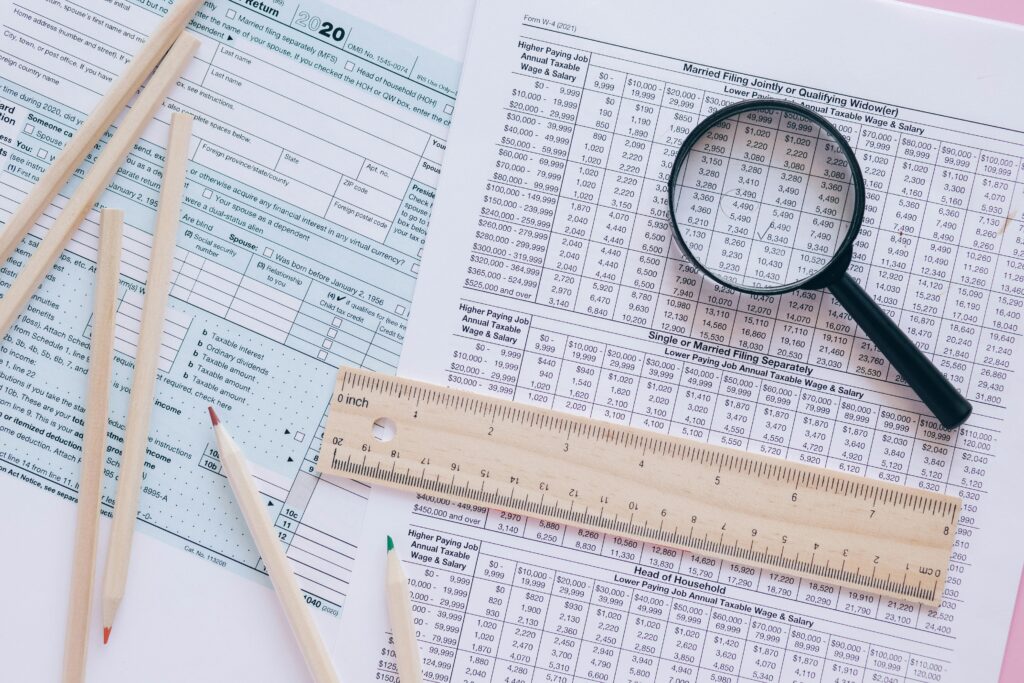

Navigating Tax Season with Annuities

Don’t panic this tax season. Understand how the IRS taxes annuities, discover legal ways to reduce your tax burden, and use these tips to protect your retirement income.

What Happens If You Miss the Medigap Enrollment Window?

The Medigap enrollment window occurs six months after you turn 65. If you miss this period, you risk higher premiums and loss of coverage. Learn more here in this guide!

What Happens to Unpaid Nursing Home Bills After Death?

Have unpaid nursing home bills after a loved one dies? Learn how debt is handled through probate, when you might be responsible, and how to protect your assets.

The True Costs Of Dying

Discover the true cost of dying at home, in a hospital, or in a care facility, plus tips to protect your family from unexpected final expenses.

An Aging in Place Checklist

Create a safer, more comfortable home as you age. Use our aging in place checklist to plan smart upgrades and stay independent for years to come.

How Much Does Assisted Living Cost?

Compare senior living options, costs, and funding sources to plan for retirement. Learn about care types, pricing factors, and financial assistance.

Annuities: Are They a Good Investment?

Wondering if annuities are a good investment for retirement? Understand the benefits, risks, and types so you can make an informed decision about your financial future.