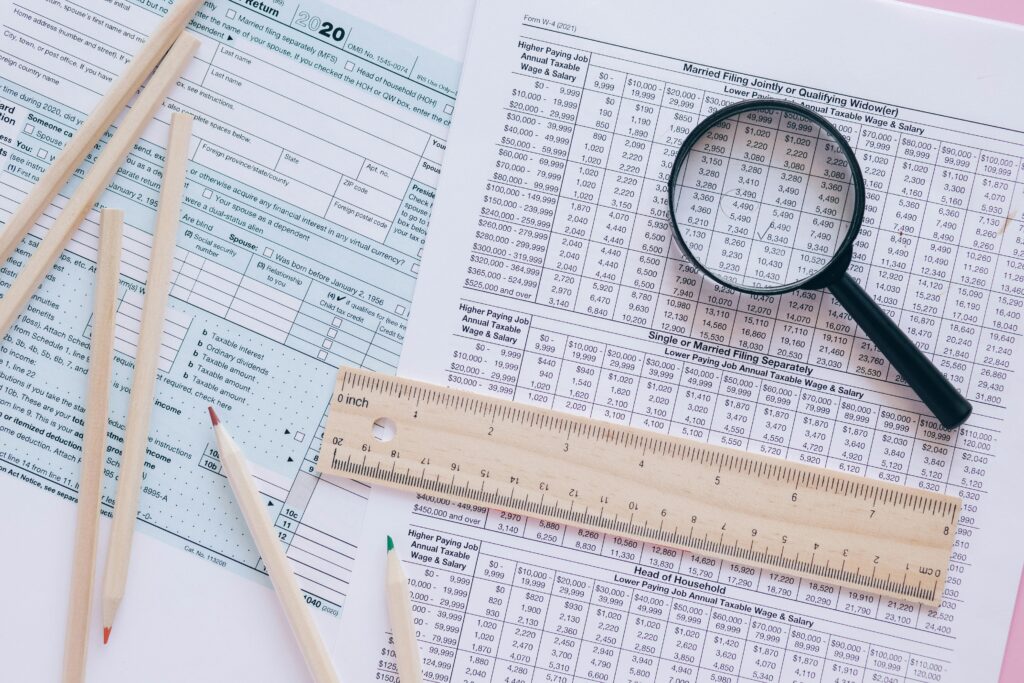

Retirement planning can feel overwhelming, but having the right financial...Read More

We Help You Simplify Your Retirement Decisions

Whether you’re in the early stages of retirement planning—or looking for ways to maximize your retirement savings—use My Guide to Retirement as a trusted resource to make your decisions simpler and your future more secure.